How AI is Set to Disrupt the Banking and Finance Industry

Artificial Intelligence (AI) has transformed various sectors, including logistics, aviation, and healthcare, among others. If the current pace continues, more AI technologies and applications will disrupt these industries bringing a floodgate of opportunities that companies can hop on.

One such industry that can take advantage of AI is banking and finance industry. It can embark on a journey from its traditional approach to a data-driven AI approach navigating towards a technologically-sound future. Are you with us on this? Let’s take a deeper dive into AI and how it is reshaping the banking and finance industry like never before.

AI & Banking: A Few Numbers Up For Glance

According to a McKinsey 2023 banking report, use of generative AI could increase productivity by up to 5% within the sector. It can also reduce global expenditures to the tune of up to $300 billion. An Accenture report dictates how AI tools could increase volume or interactions/transactions by 2-5X with the same headcount.

Additionally, citing a Business Insider report, approximately 80% of the banks are aware of AI and how it will potentially benefit the banking sector. These numbers reflect how the banking sector is moving swiftly towards adopting AI as it promises enhanced services, better productivity, and efficiency, and reduces costs considerably.

Applications of AI in Banking and Finance

Let’s check out the various applications of AI in banking and finance that could have a tectonic positive impact down the line.

Cybersecurity and Fraud Detection

A person trying to hack into someone’s laptop

As users utilize banking apps and systems to pay bills, deposit checks, withdraw money, etc., the need to have a stringent fraud detection mechanism has become paramount. One of the core functions of AI and ML is to analyze huge chunks of data to find abnormal user behavior and fraudulent activities. The fraud detection mechanisms help minimize risk and safeguard users and the entire system against such activities.

Also Read: Strengthening Cybersecurity Defenses: The Importance of VAPT for Businesses in the UAE

One such example is Danske Bank, one of the largest banks in Denmark, has integrated AI-based fraud detection algorithms. Stats suggest the move resulted in a 50% increase in fraud detection capabilities and a 60% reduction in false positives. Barclays uses AI tools to predict potential fraudulent instances by monitoring their payment transactions in real-time, minimizing the risks associated with such attacks.

Another major application of AI is cybersecurity. Financial sector has been one of the most targeted industries in the world. Having AI tools to monitor the movements of users in real time allows banks to curb potential cyberattacks. It includes monitoring anomalies in the system and taking corrective measures to prevent cyberattacks and any far-reaching impact it may trigger.

Chatbots

Daughter educating her father on using chatbot services on phone to communicate with his bank

![]()

It takes forever to reach your bank via phone or email, especially after working hours, right? Introducing AI-backed virtual assistants (also called as chatbots) that can deliver services 24/7 once deployed. Modern chatbots use AI technologies such as ML and NLP (natural language processing) to respond to user’s queries and recommend resolutions as humanly as possible.

Using AI, chatbots can upsell products and services to customers by pitching the right product at the right time that solves customer’s queries. For instance, chatbots can suggest automating bill payments for a frill-free payments experience. As the process will be automated , customers need not have to worry about paying bills every time they receive one.

This has greatly improved customer experience since users can have someone to attend to their queries 24/7. For banks, these chatbots filter user requests or queries and escalate them to the concerned department based on the urgency and severity of the issue. It eventually takes the additional load off bank employees assisting with user queries.

Risk Assessment, Improved Loan and Credit Decisions

Signing a loan contract

Traditional banks and financial centers use credit scores, references from customers, and credit history among others to define the ‘creditworthiness’ of a customer seeking out a loan or credit. However, this system is flawed in many ways as it doesn’t account for real-world transactions, or the usual behavior of the user and ends up misclassifying creditors.

Also Read: Decoding Artificial Intelligence (AI): Types, Pros, Cons, & Applications

With advanced AI technology under the hood, banks can leverage it to make well-informed loan and credit decisions. Essentially, the way how AI functions is it takes large troves of data, use algorithms (or set of instructions or processes) to find patterns and behaviors, and finally, based on the data and models, it predicts outcome(s). Banks can leverage AI to account for users’ credit history, look at their spending patterns and habits and even opt for non-traditional sources such as social media to track user’s behavior.

All this data is then used to cue a user’s creditworthiness. As AI algorithms get better with each iteration, one can even expect these AI tools to pull off predictions including but not limited to risk mitigation and likelihood of default.

Reduced Operational Costs

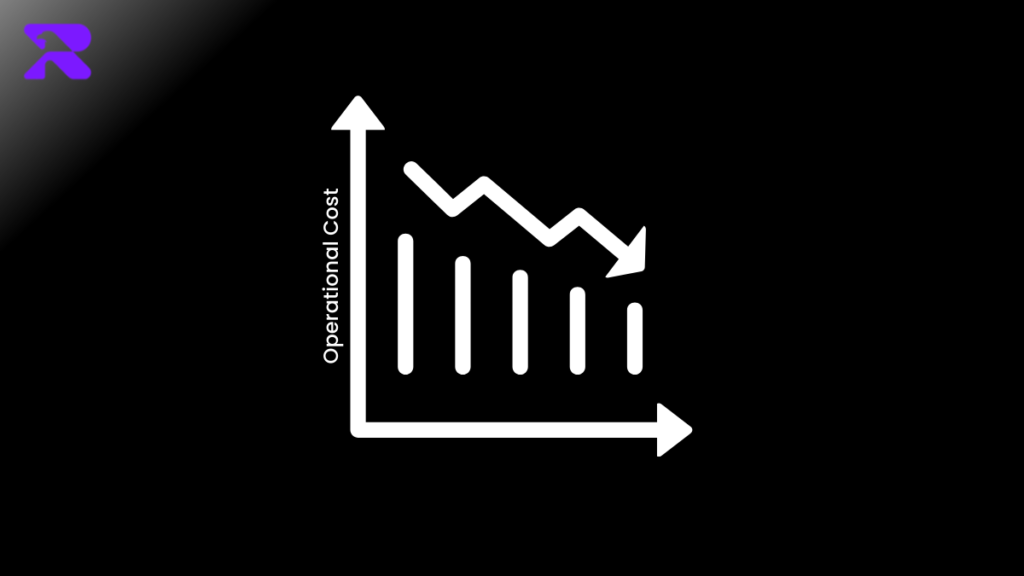

How AI can help reduce operational costs for enterprises

Banks are hurtling towards a digital future and many of the functions are already happening online. However, the sector is still riddled with paper-heavy and human-based processes. This triggers significant operational costs as a result of potential human errors especially when there are repetitive tasks involved such as data entry and account reconciliation.

With AI systems in place, banks can leverage various technologies to reduce their overheads. For instance, robotic process automation (RPA) are software-based functions that can be set up to perform repetitive tasks to reduce human errors. It also reduces the time it takes to do a particular task while achieving a higher degree of data accuracy such as in the case of form-filling, data entry, etc.

Another example is using AI with optical character recognition (OCR) to scan through documents such as various banking forms, loan applications, KYC forms, etc., account reconciliation, and transaction processing, among various other banking workflows that humans would otherwise do.

Compliance with Anti-Money Laundering (AML) Regulations

Compliance with Anti-money laundering

Money laundering is a major concern that plagues the financial system in and out. It is a criminal activity that involves disguising the origins of the funds using various laundering activities. Luckily, AI can break the spine of such activities and make the system AML-compliant.

As aforementioned, AI systems can analyze troves of data in real time. Here, AI algorithms can be trained to flag any suspicious patterns in transactions such as frequent cash deposits and unusually large transactions, among others. Banks can levy algorithms to detect user behavior by learning about the transaction data to filter any drastic shift in the activities that can be further probed by law enforcement.

AI can help discover complex relationships within a money laundering racket that might involved an insane number of individuals, businesses, organizations, and entities. With network analysis, AI can help uncover links between such parties that have been facilitating money laundering activities.

Predictive Analytics

One of the major applications of AI is predictive analytics. As the name suggests, AI systems can be trained to consume copious amounts of data. Based on the AI models fed into the systems, AI can recognize patterns leading to lost opportunities such as untapped sales or cross-sales. Predictive analytics can also help uncover hidden traits that can be hard-hitting for a bank’s revenue such as operational inefficiencies and shortcomings if left unfixed. It can be used for risk assessment in the case of credit and loan applications as explained earlier.

Another major use case is finding patterns signaling any illegal money laundering, insider trading, and other types of malpractices within the banking system. Doing this manually requires an insane amount of human resources, however, AI can do it single-handedly and point out what’s potentially wrong with a dataset (such as transactions between seemingly unrelated people).

Challenges in Adopting AI in Banking

AI has shown promising applications over the years and it’s getting better with each iterations. Having robust AI systems in place can offer untapped opportunities, however, banks usually face challenges when implementing it in their legacy systems and processes.

For instance, safeguarding data is paramount as the datasets often contain personal information about the users, their financial history, login credentials, etc. Thus, banking channels must ensure onboarding safeguarding mechanisms to prevent any data leak, breach, or misuse.

Cost plays a primary driving force behind any AI upgrades. Banks require a lot of capital to set up graphics processing units, storage, and other components to support a major AI overhaul. It isn’t just the upfront costs but there are recurring maintenance costs that banks must consider when choosing their AI systems.

Regulations and guidelines may differ from region to region. Different countries have different measures to safeguard user’s data which means banks operating in multiple regions must abide by these regulations to continue their business.

Another challenge is of power expenditure. The traditional banking systems is power-hungry, however, it doesn’t mean setting up AI systems will help clean the carbon footprint. On the contrary, AI systems have their energy consumption as well which is a major factor for companies watching over their ESG parameters – environmental, social, and governance.

Risks of AI in Banking

AI in banking does have a plethora of benefits, however, there are some risks associated with it as well. It is similar to the two sides of a coin, where there are pros, there will be cons, although how an organization approaches mitigating these risks can be subjective.

First up, AI models are trained on large amounts of data. There’s a quote that says output of any AI system is only as good as its input. If a banking channel inputs incorrect or flawed data, the output would carry similar traits looping them in a financial implication. Thus, banks must exercise stringent control over the data, how it is fed, and the outputs that can be further improved by tweaking parameters.

Moreover, there’s an ongoing debate on exactly how AI models make their decisions that has made people skeptical about using AI. The financial institutions retain confidential user data carrying user identification, banking details, and other credentials. Uploading such data on AI systems carries risks of data leakage and that’s why it is critical for the banks to protect data and shield it from public view preventing any malpractices.

Time and again, we have seen how AI algorithms can be biased leading to unfair decisions. An XYZ bank reportedly denied loan applications from people of certain demographics as the AI predictive higher probability of default based on the data it was trained.

Closing Words

The emergence of AI has reshaped a lot of industries. The banking is a major sector where AI can bring about a paradigm shift to how it operates. AI applications can be deployed across varied functions right from automating repetitive tasks, account reconciliation, enhancing customer experience, and fortifying cybersecurity measures, to name a few.

Banks can leverage AI for predictive analytics to identify patterns and gain insights into the outcome of any financial transaction. AI can improve cloud storage and security. It facilitates banks with scalable and reliable cloud options and eliminate the need to pay for expensive infrastructure upfront and maintain them from time to time. Overall, AI is revolutionizing the banking and finance sector making it imperative for banks to make a move towards innovation with AI systems sitting at the helm.

About RA Technologies

RA Technologies (RASOC) is a leading managed security solutions provider in the UAE. Our mission is to bolster your businesses with robust cybersecurity measures by fortifying the critical systems, the data, and the people from any digital threats. We have extensive experience in end-to-end cybersecurity solutions including VAPT, EDR, SIEM, SOAR, MDR, and Digital Forensics.

With a proven track record, incredible response time, and excellent customer service, we have consistently outranked many competitors in protecting organizations against threats that would’ve otherwise caused widespread distrust, loss of reputation, and financial implications to a greater degree.

Need custom-made managed security solutions for your organization? Look no further as RASOC has it all set up under one roof offering you complete peace of mind while our experts will take care of your cybersecurity measures. For more information, call +971 4 210 1900 to connect with an expert to get personalized advice and action plans.

July 31, 2024

July 31, 2024